And then we post them in the general ledger. Remember the accounting equation. To the right of the account titles are two columns for entering each accounts balance. A trial balance is a list of all accounts in the general ledger that have nonzero balances. Debit the account when the assetsexpenses increase and the liabilitiesrevenues decrease. One just needs to remember these rules to record all the transactions in the books of accounts. How To Prepare The Trial Balance. Steps to prepare trial balance Step-1 Debit and Credit Rule. Bookkeepers and accountants use this report to consolidate all of the T-accounts into one document and double check that all transactions were recorded in proper journal entry format. The four basic steps to developing a trial balance are as follows.

Note that for this step we are considering our trial balance to be unadjusted. These cover the initial entries into the spreadsheet. The heading for the trial balance is made up using details relating to name of the organisation and the instance to which the ledger account balances pertain. For account names debit quantity and credit quantities. The account number should be the four-digit number assigned to the account when you set up the chart of accounts. Total up the credit amounts and debit amounts for each ledger account separately. Each accounts balance is listed in the appropriate column. To the right of the account titles are two columns for entering each accounts balance. Trial balance is an important Step of the accounting cycle - which is a series of steps performed during an accounting period to analyze record classify summarize and report financial information for generating financial statements. Producing the trial balance is the final step of data processing after that we can start producing our financial statements.

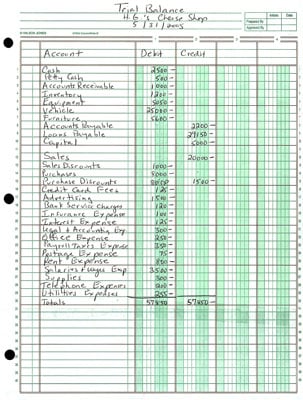

A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Trial balance is an important Step of the accounting cycle - which is a series of steps performed during an accounting period to analyze record classify summarize and report financial information for generating financial statements. Create an eight-column worksheet with column headers for the account number account name debit total and credit total. A trial balance is a list of all accounts in the general ledger that have nonzero balances. The account number should be the four-digit number assigned to the account when you set up the chart of accounts. The heading for the trial balance is made up using details relating to name of the organisation and the instance to which the ledger account balances pertain. To prepare a trial balance follow these steps. Debit the account when the assetsexpenses increase and the liabilitiesrevenues decrease. List every open ledger account on your chart of accounts by account number. Suspense account is created to agree the trial balance totals temporarily until corrections are accounted for.

To ensure the balance sheet is balanced it will be necessary to compare total assets against total liabilities plus equity. The header row consists of the labels for the information present in the trial balance. Fill in all the account titles and record their balances in the appropriate debit or credit columns. Definition of a Trial Balance. This method takes a lot of time but it is very systematic and usually. Total the debit and credit columns. Each accounts balance is listed in the appropriate column. Assets liabilities equity dividends revenues and expenses. Steps for Preparing a Trial Balance. To prepare a trial balance follow these steps.

Definition of a Trial Balance. All Ledger Accounts are closed at the end of an accounting period. Each row in the trial balance pertains to the information relating to an account. The title of each general ledger account that has a balance. Compare the column totals. Create an eight-column worksheet with column headers for the account number account name debit total and credit total. Prepare a worksheet with three columns. The account number should be the four-digit number assigned to the account when you set up the chart of accounts. Bookkeepers and accountants use this report to consolidate all of the T-accounts into one document and double check that all transactions were recorded in proper journal entry format. Although you can prepare a trial balance at any time you would typically prepare a trial balance before preparing the financial statements.