The types of financial analysis are as follows. To analyze interpret the financial statements commonly used tools are comparative statements common size statements etc. Financial reporting and analysis give investors creditors and other businesses an idea of the financial integrity and creditworthiness of your company. Financial Analysis and Appraisal of Projects Chapter 3 Page 2 of 43 314 These Guidelines holistically addresses project appraisal from a financial perspective. Financial reporting software provides crucial information that you can use to make better business decisions for example whether you should open a new branch or not. Tools of Financial Analysis Financial statements are prepared to have complete information regarding assets liabilities equity reserves expenses and profit and loss of an enterprise. Vertical analysis and horizontal analysis. As an example suppose the average accounts receivable days outstanding three years ago. Comparative Financial Statements statement of changes in working capital common size balance sheets and income. Financial analysis involves the review of an organizations financial information in order to arrive at business decisions.

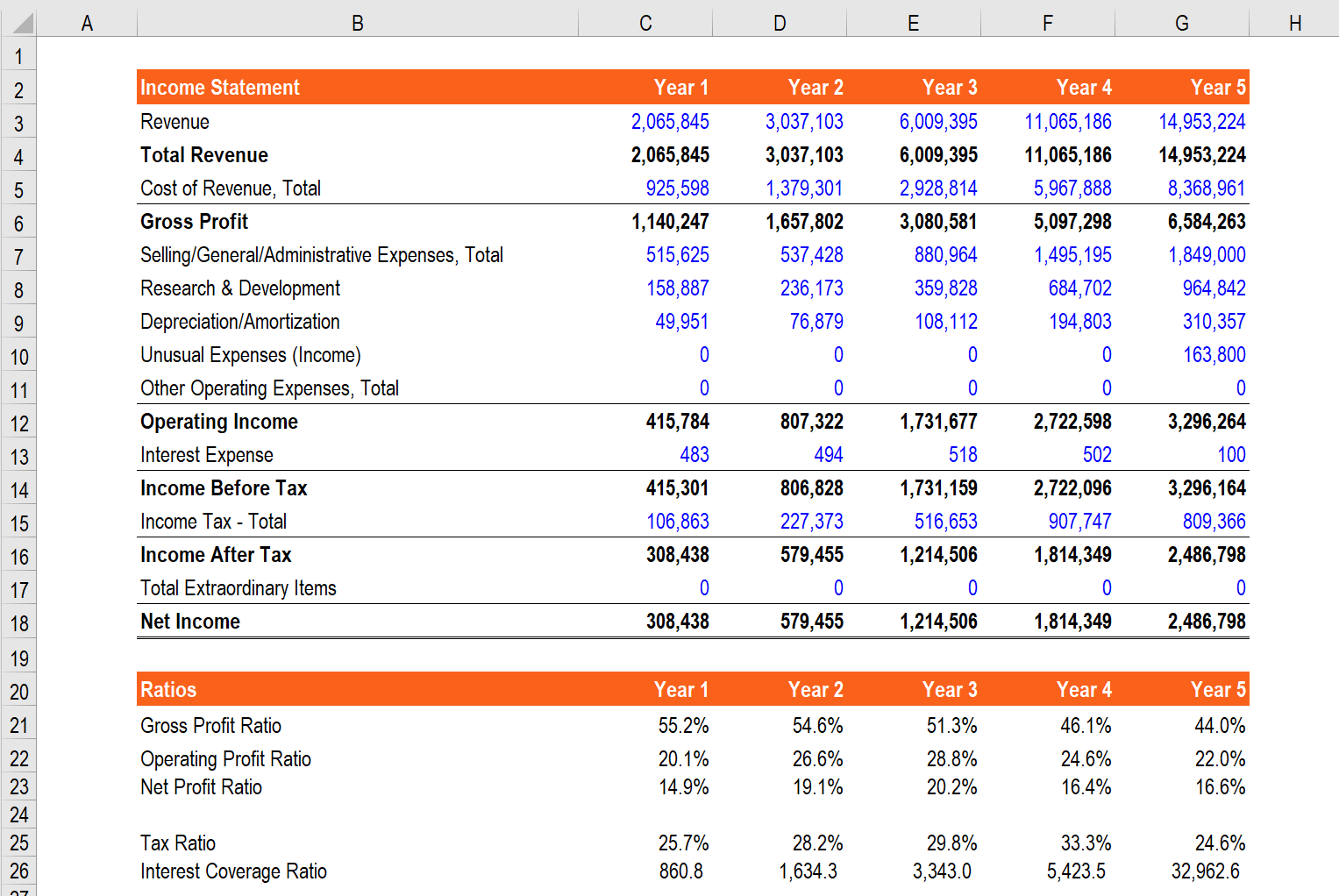

Vertical analysis With this method of analysis of financial statements we will look up and down the income statement hence vertical analysis to see how every line item compares to revenue as a percentage. They integrate the financial analysis of the project within the overall financial framework and financial management of the Executing Agency EA. Example of Financial analysis is analyzing companys performance and trend by calculating financial ratios like profitability ratios which includes net profit ratio which is calculated by net profit divided by sales and it indicates the profitability of company by which we can assess the companys profitability and trend of profit and there are more ratios like liquidity ratios turnover ratios and solvency ratios. This analysis can take several forms with each one intended for a different use. To analyze interpret the financial statements commonly used tools are comparative statements common size statements etc. Vertical analysis and horizontal analysis. Horizontal analysis compares the ratios from several years of financial statement side by side to detect trends. Financial reporting and analysis give investors creditors and other businesses an idea of the financial integrity and creditworthiness of your company. Tools of Financial Analysis Financial statements are prepared to have complete information regarding assets liabilities equity reserves expenses and profit and loss of an enterprise. Financial analysis involves the review of an organizations financial information in order to arrive at business decisions.

Tools of Financial Analysis Financial statements are prepared to have complete information regarding assets liabilities equity reserves expenses and profit and loss of an enterprise. Financial Analysis and Appraisal of Projects Chapter 3 Page 2 of 43 314 These Guidelines holistically addresses project appraisal from a financial perspective. These include comparisons for profit margins liquidity turnovers and financial leverage. The types of financial analysis are as follows. As an example suppose the average accounts receivable days outstanding three years ago. There are two main types of analysis we will perform. Example of Financial analysis is analyzing companys performance and trend by calculating financial ratios like profitability ratios which includes net profit ratio which is calculated by net profit divided by sales and it indicates the profitability of company by which we can assess the companys profitability and trend of profit and there are more ratios like liquidity ratios turnover ratios and solvency ratios. Horizontal analysis compares the ratios from several years of financial statement side by side to detect trends. Financial analysis involves the review of an organizations financial information in order to arrive at business decisions. Let us take a look.

The types of financial analysis are as follows. Comparative Financial Statements statement of changes in working capital common size balance sheets and income. There are two main types of analysis we will perform. Financial reporting and analysis give investors creditors and other businesses an idea of the financial integrity and creditworthiness of your company. As an example suppose the average accounts receivable days outstanding three years ago. Vertical analysis and horizontal analysis. They integrate the financial analysis of the project within the overall financial framework and financial management of the Executing Agency EA. Horizontal Analysis This involves the side-b. Financial analysis involves the review of an organizations financial information in order to arrive at business decisions. These include comparisons for profit margins liquidity turnovers and financial leverage.

Financial reporting and analysis give investors creditors and other businesses an idea of the financial integrity and creditworthiness of your company. These include comparisons for profit margins liquidity turnovers and financial leverage. There are two main types of analysis we will perform. Let us take a look. Horizontal Analysis This involves the side-b. Vertical analysis and horizontal analysis. This analysis can take several forms with each one intended for a different use. Example of Financial analysis is analyzing companys performance and trend by calculating financial ratios like profitability ratios which includes net profit ratio which is calculated by net profit divided by sales and it indicates the profitability of company by which we can assess the companys profitability and trend of profit and there are more ratios like liquidity ratios turnover ratios and solvency ratios. Financial reporting software provides crucial information that you can use to make better business decisions for example whether you should open a new branch or not. As an example suppose the average accounts receivable days outstanding three years ago.