There is no specific requirement for the classifications to be included in the balance sheet. When supplies are classified as assets they are usually included in a separate inventory supplies account which is then considered part of the cluster of inventory accounts. The account has not yet been paid. Accounting for Manufacturing Supplies The cost of manufacturing supplies on hand at the end of an accounting period will be reported in a balance sheet current asset account such as Inventory of Manufacturing Supplies. A classified balance sheet is a type of balance sheet presented so that the sub-components of assets liabilities and equity are presented so that the readers get a better understanding of the items of the financial statements. The following items at a minimum are normally found in a balance sheet. Assets held for sale. The broader headings are broken down into simpler smaller headings for better readability of the annual accounts. Cash and cash equivalents. If the deposit will be repaid within a year it should be classified as a current asset or a current liability on the balance sheet depending on whether the company paid or collected it.

If the deposit will be repaid within a year it should be classified as a current asset or a current liability on the balance sheet depending on whether the company paid or collected it. They are presented on the balance sheet after the current assets and may include the following classifications. Initial Balance Sheet Starting a Company 5 Returns defective raw materials purchased in 4 and costing 900 to the supplier. So in the case of supplies if the value of the supplies is significant enough to total at least five percent of your total assets you should report it as a current asset on your. Lets review each classification in greater detail. Trade and other receivables. If so supplies then appear within the inventory line item in the balance sheet. The firm treats cash discount as a reduction in the acquisition cost of raw materials. The account has not yet been paid. Fixed assets intangible assets investments and other non-current assets.

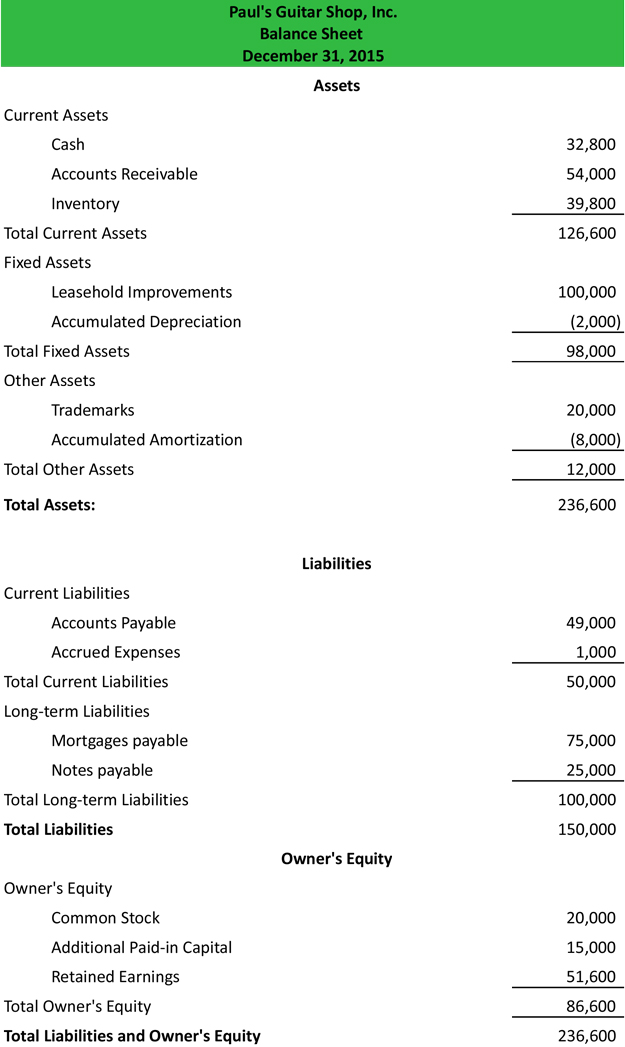

Bond payable will be paid with sinking fund in. Both an unclassified and a classified balance sheet include asset liability and equity balances but an unclassified balance sheet does not classify amounts. There are likely to be several accounts or sub-accounts in order keep track of the manufacturing supplies by category. Fixed assets may include land buildings machinery and equipment vehicles and leasehold improvements. Accounting for Manufacturing Supplies The cost of manufacturing supplies on hand at the end of an accounting period will be reported in a balance sheet current asset account such as Inventory of Manufacturing Supplies. Account Title Classification Financial Statement Normal Balance L Land Plant Asset Balance Sheet Debit Loss on Disposal of Plant Assets Other Expense Income Statement Debit M. A classified balance sheet is a type of balance sheet presented so that the sub-components of assets liabilities and equity are presented so that the readers get a better understanding of the items of the financial statements. It simply lists them under their. Common Balance Sheet Classifications. Fully depreciated machinery still in use.

A classified balance sheet is a type of balance sheet presented so that the sub-components of assets liabilities and equity are presented so that the readers get a better understanding of the items of the financial statements. Cash and cash equivalents. There is no specific requirement for the classifications to be included in the balance sheet. Initial Balance Sheet Starting a Company 5 Returns defective raw materials purchased in 4 and costing 900 to the supplier. Due in 2007 Current Asset. There are likely to be several accounts or sub-accounts in order keep track of the manufacturing supplies by category. If the deposit wont be repaid for more than a year it should be recorded as a long-term asset or long-term liability based on the same criteria. Securities and Exchange Commission in 1999 any item representing five percent or more of a businesss total assets should be deemed material and listed separately on its balance sheet. As an asset Based on your account classifications determined in the previous steps calculate the total amount of assets and liabilities of Assets Amount Liabilities Amount Cash 3500 Accounts payable 2400 Supplies 2400 Office equipment 4500 Total assets 10400 Total liabilities 2400 So total. They are presented on the balance sheet after the current assets and may include the following classifications.

Short-Term Investments Current Asset Balance Sheet Debit Supplies Current Asset Balance Sheet Debit. Fixed assets intangible assets investments and other non-current assets. According to guidelines set by the US. If the deposit wont be repaid for more than a year it should be recorded as a long-term asset or long-term liability based on the same criteria. Initial Balance Sheet Starting a Company 5 Returns defective raw materials purchased in 4 and costing 900 to the supplier. The broader headings are broken down into simpler smaller headings for better readability of the annual accounts. 3Salaries and wages payable. Due in 2007 Current Asset. The account has not yet been paid. Fully depreciated machinery still in use.