Trade and office expanses is debit or credit balance in trial balance. In contrast the credit side includes liabilities capital accounts income accounts sundry creditors sales gains and reserves. Its purpose is to test the equality between debits and credits after adjusting entries are made ie after account balances have been updated. Keeping this in consideration what goes on the credit side of a. Ad This is The Newest Place to Search Delivering Top Results from Across the Web. The format of the trial balance is a two-column schedule with all the debit balances listed in one column and all the credit balances listed in the other. Click to see full answer. The trial balance is a bookkeeping systematized worksheet containing the closing balances of all the accounts. Debits include accounts such as asset accounts and expense accounts. Lucky on August 26 2018.

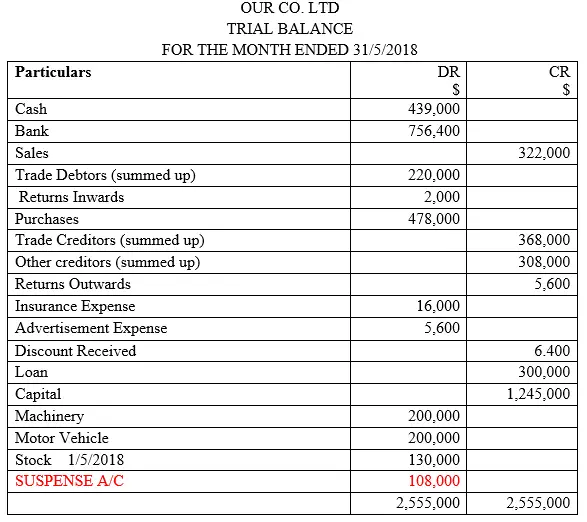

To do a trial balance properly you have to know trial balance items list first. Asset and expense accounts appear on the debit side of the trial balance whereas liabilities capital and income accounts appear on the credit side. A trial balance is a list and total of all the debit and credit accounts for an entity for a given period usually a month. Lucky on August 30 2018. Find Content Updated Daily for credit balance. The ledger balances ie of all expenses incomes receipts payments assets liabilities share premiums etc. The trial balance has two sides the debit side and the credit side. Is loan interest debit or credit on September 23 2018. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from cash book. It has our assets expenses and drawings on the left the debit side and our liabilities revenue and owners equity on the right the credit side.

Ad 1800 Templates to Choose From Simply Fill-in the Blanks Print. If totals are not equal it means that an error was made in the recording andor posting process and should be investigated. The totals of these two sides should be equal. Lucky on August 26 2018. The trial balance is used to test the equality between total debits and total credits. The ledger balances ie of all expenses incomes receipts payments assets liabilities share premiums etc. Click to see full answer. If so which side. Robin on September 17 2018. The capital revenue and liability increases when it is credited and visa versa.

It shows a list of all accounts and their balances either under the debit column or credit column. Click to see full answer. Debits include accounts such as asset accounts and expense accounts. The trial balance has two sides the debit side and the credit side. Its purpose is to test the equality between debits and credits after adjusting entries are made ie after account balances have been updated. Keeping this in consideration what goes on the credit side of a. The capital revenue and liability increases when it is credited and visa versa. Ad This is The Newest Place to Search Delivering Top Results from Across the Web. Are to be reported in the trial balance. Lucky on August 26 2018.

Robin on September 17 2018. The trial balance has two sides the debit side and the credit side. Find Content Updated Daily for credit balance. Are to be reported in the trial balance. Credits are accounts such as income equity and liabilities. If all accounting entries are recorded correctly and all the ledger balances are accurately extracted the total of all debit balances appearing in the trial balance must equal to the sum of all credit balances. After adjusting entries are made an adjusted trial balance can be prepared. Click to see full answer. The debit side and the credit side must balance meaning the value of the debits should equal the value of the credits. Is loan interest debit or credit on September 23 2018.